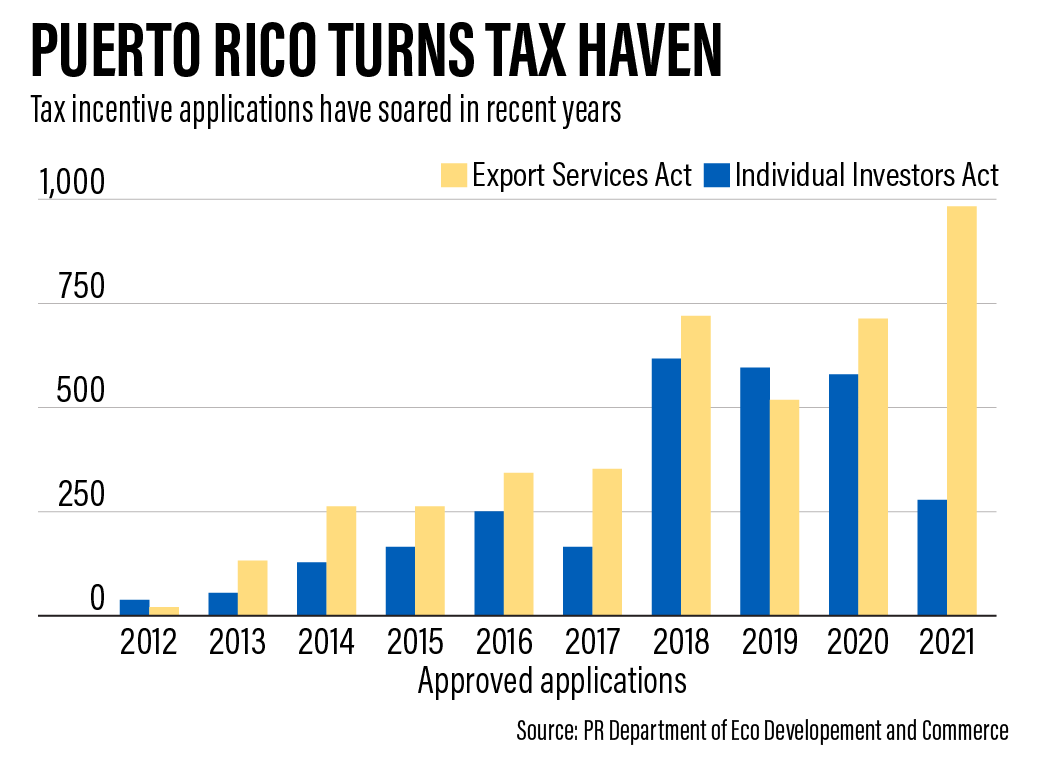

puerto rico tax incentives 2021

The code organizes commonwealth laws covering commonwealth income tax payroll taxes gift taxes estate taxes and statutory excise taxes. TaxFormFinder provides printable PDF copies of 775 current Federal income tax forms.

How Puerto Rico Is Turning Into A Cryptocurrency Island With Zero Taxes

Puerto Ricos resident investor incentive commonly known as Act 22 lures wealthy individuals with the promise of legally skirting US.

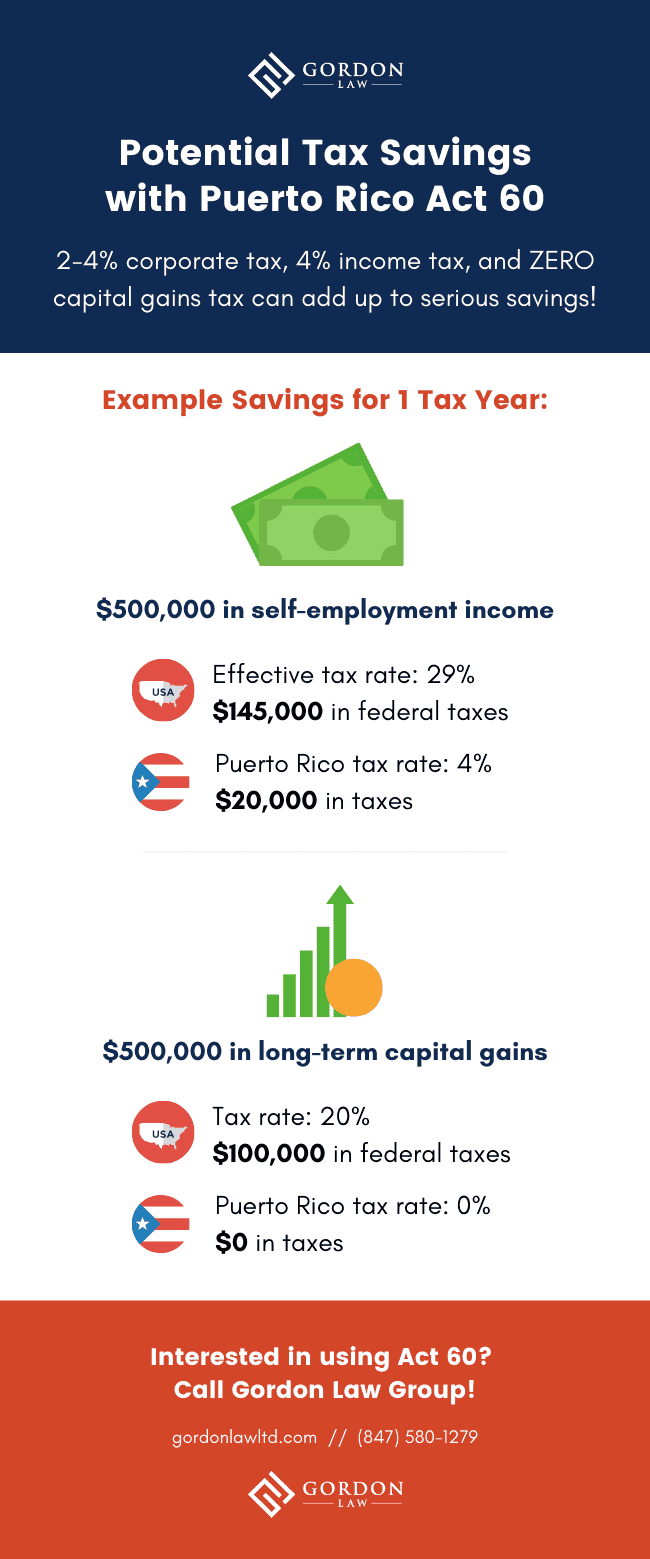

. All federal employees those who do business with the federal government Puerto Rico. Thanks to Act 60 cryptocurrency and blockchain entrepreneurs who spend 183 days or more in Puerto Rico dont have to pay taxes on capital gains and. Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico.

Cantonal and communal CITs are added to federal CIT resulting in an overall effective tax rate between 119 and 216 depending on the companys location of corporate residence in Switzerland. 85 on profit after tax 783 on profit before tax. There are no tax treaties between foreign countries and Puerto Rico.

Hiring Incentives to Restore Employment HIRE Act. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. An annual informative return is also required to be filed no later than 15 April of the following year.

Jim Wyss Jan 20 2022. Such tax is due on or before the 15th day of the month following the receipt of the income by the non-resident corporation. The main body of domestic statutory tax law in Puerto Rico is the Código de Rentas Internas de Puerto Rico Internal Revenue Code of Puerto Rico.

Guide To Income Tax In Puerto Rico

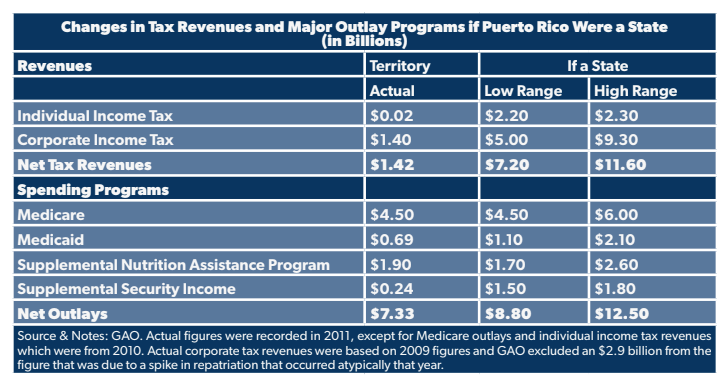

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax And Incentives Guide Grant Thornton

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Guide To Income Tax In Puerto Rico

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22